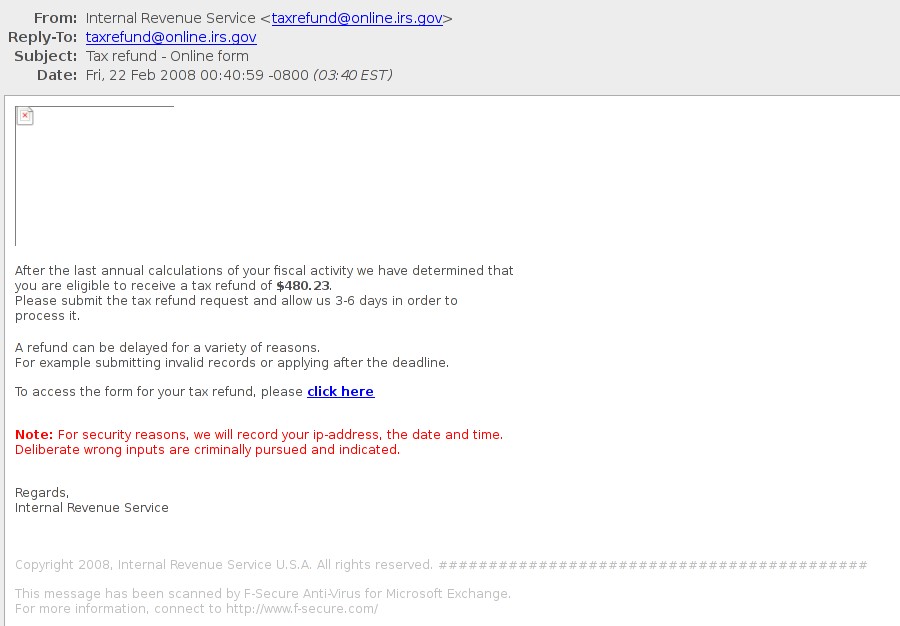

Don’t fall for it! If you get an e-mail like this don’t click on the link, because it’s NOT from the IRS. It’s someone is trying to fool you into giving them your bank account number and social security number.

After the last annual calculations of your fiscal activity we have determined that you are eligible to receive a tax refund of $480.23.

Please submit the tax refund request and allow us 3-6 days in order to process it.A refund can be delayed for a variety of reasons.

For example submitting invalid records or applying after the deadline.To access the form for your tax refund, please click here

Note: For security reasons, we will record your ip-address, the date and time.

Deliberate wrong inputs are criminally pursued and indicated.Regards,

Internal Revenue Service

I’m not leaving the link in that was in the original e-mail, in case someone clicks on it and thinks it the real IRS. But it leads you to a site that looks just like the IRS’s website. This is what the e-mail looked like:

Just enough information to make you think it is from the IRS, but trust me it is NOT from the IRS. See the IRS’s website for more information, where they say:

Updated Jan. 14, 2008 — A new variation of the refund scheme may be directed toward organizations that distribute funds to other organizations or individuals. In an attempt to seem legitimate, the scam e-mail claims to be sent by, and contains the name and supposed signature of, the Director of the IRS Exempt Organizations area of the IRS. The e-mail asks recipients to click on a link to access a form for a tax refund. In reality, taxpayers claim their tax refunds through the filing of an annual tax return, not a separate application form.

See http://www.irs.gov for more information.